Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

- The state that has the lowest property tax is Hawaii with an average rate of around 0.27%.

- Other states with low property tax rates include Alabama (0.39%), Colorado (0.49%), and Louisiana (0.50%).

- There are no US states without a property tax, although some have significantly lower rates than others.

What state has the lowest property tax?*

The state that has the lowest property tax is Hawaii with an average rate of around 0.27%, as it relies primarily on tourism-related taxes to fund public services. However, despite the low tax rate, homeowners often end up paying more because of the state's extortionate house prices.

Other American states with low property tax rates include Alabama (0.39%), Colorado (0.49%), and Louisiana (0.50%). While Alabama benefits from cheaper homes and state laws restricting tax increases and Louisiana offers a homestead exemption, reducing the taxable value of primary residences, Colorado utilises a unique Gallagher Amendment, which historically kept residential property taxes low compared to commercial rates.

While these states offer homeowners financial relief through lower tax rates, other factors such as income taxes, sales taxes, and public service funding should be considered when evaluating the overall tax burden.

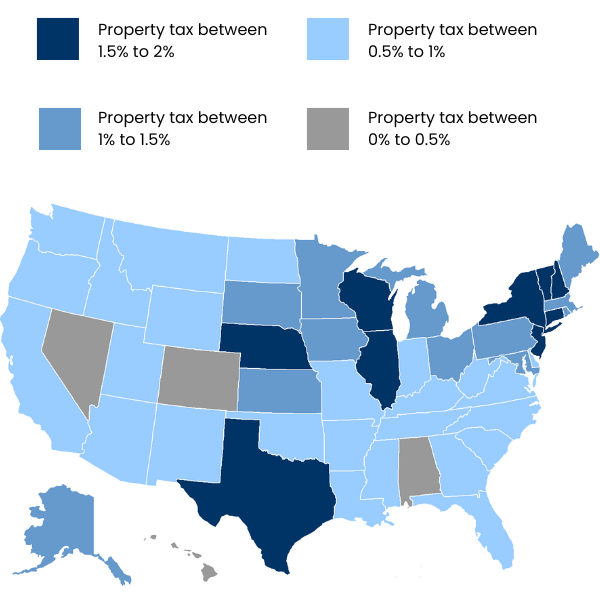

Property taxes by state

The graph below shows the range of property tax rates by state across the US:

![]()

10 states with lowest property taxes

To help with your move to the US, the table below shows the 10 states with the lowest property taxes and their median house prices:

| State | Property tax rate | Median home value |

| Hawaii | 0.27% | US$759,500 (£605,800) |

| Alabama | 0.39% | US$282,000 (£224,900) |

| Colorado | 0.49% | US$601,500 (£479,800) |

| Nevada | 0.50% | US$457,800 (£365,183) |

| South Carolina | 0.53% | US$370,100 (£295,200) |

| Louisiana | 0.55% | US$251,500 (£200,600) |

| Utah | 0.55% | US$557,000 (£444,315) |

| Delaware | 0.55% | US$350,000 (£279,200) |

| West Virginia | 0.55% | US$246,200 (£196,400) |

| Arizona | 0.56% | US$451,100 ($359,839) |

Source: taxfoundation.org

*tax rates accurate as of 2025

Property taxes fund essential services like public schools, police and fire departments, and road maintenance.

States with no property tax

There are no US states without a property tax, although some have significantly lower rates than others. Within states, local governments levy annual property taxes on real estate, including land and buildings, based on their value. Some states, such as Connecticut, Virginia, Mississippi and Rhode Island, also tax personal property, including vehicles and business equipment. Many jurisdictions offer exemptions or reductions for certain groups, such as seniors, those with disabilities and veterans.

When buying a home, it's important to budget ahead of time. Property taxes fund essential services like public schools, police and fire departments, and road maintenance. Local governments calculate property rates based on a percentage of the home's market value multiplied by the local tax rate (sometimes called the "millage rate"). For example, if a home is worth US$200,000 (£159,500) and the tax rate is 1.5%, the yearly property tax would be US$3,000 (£2,300).