Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

- The states with the lowest income taxes are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

- Texas does not have a state income tax, making it a financial haven for many expats and businesses.

- "State tax burden" refers to a state's overall financial impact on the total taxes an individual owes — it includes income tax, property tax, and sales and excise tax.

...federal income taxes, charged progressively from 10 to 37% depending on income, apply to all.

States with lowest income tax

The states with the lowest income taxes are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Each state charges zero income taxes for residents. However, when moving to the US, it's important to remember that federal income taxes, charged progressively from 10 to 37% depending on income, apply to all. Many states fund public services through other means, such as higher sales or property taxes, tourism (Florida and Nevada) and the sale of natural resources (Alaska and Wyoming).

While free from state-level income taxes, Washington charges a 7% capital gains tax when selling assets such as stocks, bonds and business interests over US$250,000 (£199,423) annually. New Hampshire, which also levies zero state income taxes, charges 3% on all interest and dividend gains as of 2025, down from 4% in 2024 and 5% in 2023.

Does Texas have state income tax?

Texas does not have a state income tax, making it a financial haven for many expats and businesses. This tax-friendly policy attracts entrepreneurs, remote workers and retirees looking to maximise their income. The Lone Star State generates revenue to fund public services like schools, roads, and emergency services through other means, such as combined state and local sales tax (one of the country's highest at 8.2%), property taxes and business franchise levies.

Without state income tax, residents have more disposable income for local goods and services, such as entertainment, retail and dining. This, in turn, supports the Texan economy by increasing demand, encouraging growth and creating jobs. Thanks to zero business state taxes, Texas is an increasingly favoured location for new companies looking to minimise operational costs. The state's business-friendly environment, tax incentives, and low regulatory burdens make it a hotspot for tech startups, manufacturing, and energy companies.

Top 5 states by highest overall tax burden*:

| State | Total tax burden | Income tax | Property tax | Sales and excise tax |

| New York | 12.02% | 4.63% | 4.36% | 3.03% |

| Hawaii | 11.8% | 3.82% | 2.64% | 5.34% |

| Vermont | 11.12% | 3.09% | 4.85% | 3.18% |

| Maine | 10.74% | 2.59% | 4.86% | 3.29% |

| California | 10.4% | 4.87% | 2.73% | 2.8% |

Top 5 states by lowest overall tax burden*:

| State | Total tax burden | Income tax | Property tax | Sales and excise tax |

| Alaska | 4.93% | 0% | 3.54% | 1.39% |

| New Hampshire | 5.63% | 0.15% | 4.51% | 0.97% |

| Wyoming | 5.70% | 0% | 3.10% | 2.60% |

| Florida | 6.05% | 0% | 2.61% | 3.44% |

| Tennessee | 6.07% | 0.05% | 1.64% | 4.38% |

*tax rates accurate as of 2025

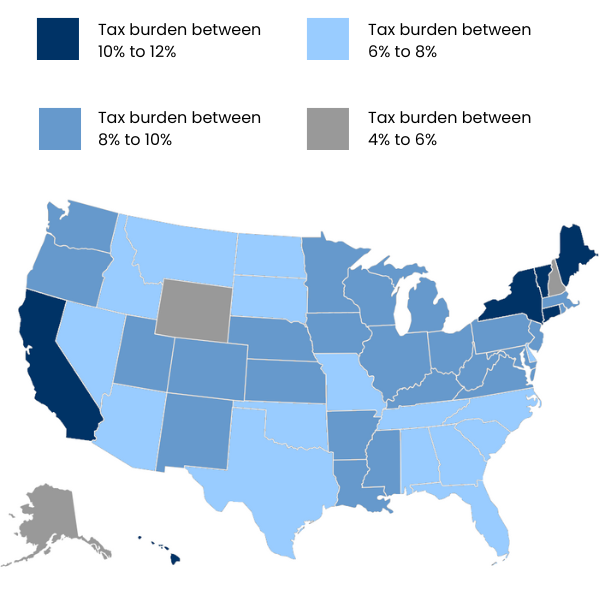

Tax burden by state*

Deciding which US state has the least impact on your income is not as simple as moving to a state with the lowest income tax. Instead, a better indicator is each state's overall financial impact, including the total taxes individuals owe — known as "state tax burden".

You can calculate state tax burden by combining the following rates:

- Income tax: progressive or flat tax rates, including deductions and exemptions.

- Property tax: based on your home's value, individual city/town tax rates, and potential relief programs.

- Sales and excise tax: state vs. local rates, there may be exemptions on essentials, such as groceries and medicine.

States like Texas tempt new residents with zero state income tax, but they make up for it with higher sales and property taxes. According to Wallethub, despite having a state income tax of 3.75%, Delaware's overall tax burden (6.43%) is lower than Texas (7.56%).

Alongside the highest cost of living in the US, New York tops the tax burden list at 12.02%. Arguably, the state's high quality of living, including outstanding educational institutions and plentiful cultural offerings, is sufficient compensation. At the opposite end of the table sits Alaska, with an overall tax burden of 4.93%. However, Alaska's remote location, challenging weather, and fewer job opportunities than more populous states make it a less popular relocation destination (although the state does offer paid incentives to move there!). Evaluating the entire picture before deciding where to move to in the United States is essential.

*tax rates accurate as of 2025