Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

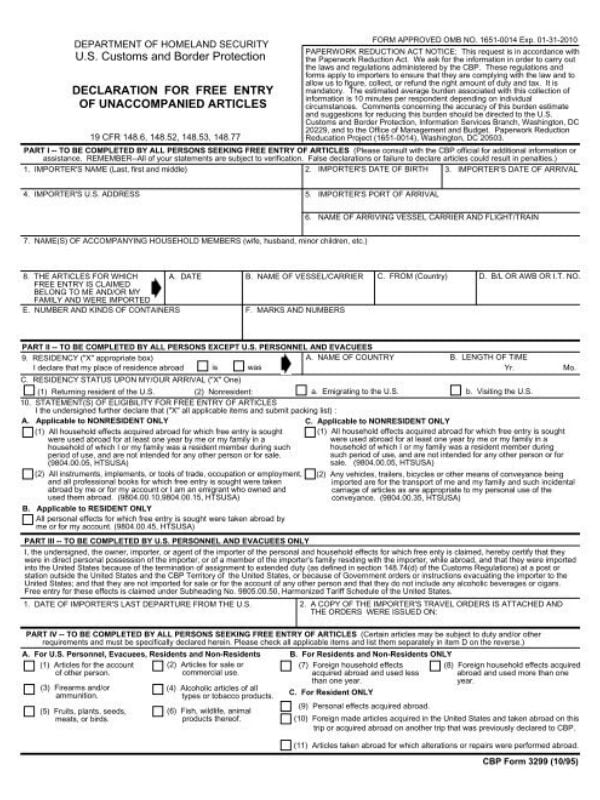

- The US customs declaration form 3299 is a mandatory document that new immigrants and returning citizens must complete to ship unaccompanied personal effects into the United States duty-free.

- Those eligible for tax relief with a 3299 form are returning US residents, first-time immigrants, citizens who moved abroad permanently and are now returning and US government personnel and their families.

- Fill out a US customs declaration form by providing the importer's information, statements of eligibility and the carrier's certificate, and then declare whether any articles belong to a banned category, how long you have owned them and if you have purchased them abroad.

What is US customs declaration form 3299?

The US customs declaration form 3299 is a mandatory document that new immigrants and returning citizens must complete to ship unaccompanied personal effects into the United States. It is also known as a "Declaration for Free Entry of Unaccompanied Articles".

Personal belongings include household goods and everyday items, such as clothing, sporting equipment, furniture and electronics, that you import into the US via an international removals company and arrive separately from you.

You may be able to import all items duty-free, provided they meet specific criteria set by US Customs and Border Protection (CBP). 3299 forms are commonly used by US citizens returning from extended stays abroad, foreign expats moving to the US, or temporary residents, such as students or contracted workers.

To complete a 3299 form, you must provide detailed information about all imported items, their origins and their owner's recent travel history.

US 3299 form sample

Below is a sample of the US customs form. It's only available in English and must be completed in English, the standard language of the United States. However, there is guidance available in Spanish.

Who is eligible for tax relief with a US 3299 form?

People eligible for tax relief with a US 3299 form include returning US residents, first-time immigrants, non-residents and US government personnel. However, you can not resell your imported belongings and must have owned them for at least 12 months before you arrive.

Here is some more information on who is eligible:

- Returning US residents: US citizens or permanent residents re-entering the country after a temporary stay abroad (less than three years), e.g. a period of study or a short-term work contract.

- First-time immigrants: non-residents moving to the United States for the first time who wish to become permanent residents.

- Nonresidents: US citizens who moved abroad permanently and are now returning after three or more years. Plus, temporary visitors, such as students and contract workers under specific visa programs, and part-time residents.

- US government personnel: military members, government workers, and their dependents returning to the States under official travel orders.

- Accompanying household members: immediate family of the lead importer also entering the US. They must be listed on the form and have their belongings declared accordingly.

Those moving to the USA for the first time must be in the country when their shipment arrives while returning US citizens don't need to be present. However, they must provide transportation details on their customs documents, including their future arrival date, flight number and chosen airline.

How do I fill out a US customs declaration form?

To fill out a US customs declaration form accurately and in compliance with customs regulations, you must follow several steps. Typically, the removals company that sends your belongings will require you to fill out this form before shipping.

A CBP Form 3299 is three pages long and includes seven parts, all styled in Roman numerals.

Follow our step-by-step guide below or check the official Customs and Border Protection website for more details.

Part I - importer's information:

- Importer's full name, date of birth and US address.

- Date and port of arrival, method of transport and names of accompanying household members.

- Shipment date, carrier name, origin country, bill of lading number, container types and any identifying marks*.

Part II - statement of eligibility:

- Relevant statements about the imported household effects.

Part III - US personnel and evacuees only:

- For individuals returning under official US government travel orders.

Part IV - declaration:

- Indicate whether your articles belong to a banned category, such as "articles for sale or commercial use" or "fruits, plants, seeds, meats, or birds", how long you have owned them and if you have purchased them abroad.

- Separately list all items you're shipping in item D list of articles.

Part V - carrier's certificate:

- Provide the carrier's name and the agent's dated signature for goods transported by an international moving company.

Part VI - certification:

- To be signed and dated by your importer or authorised agent, presenting proof of authorisation if required*.

Part VII - CBP use only:

- Leave blank for US customs officials to complete.

*Typically, this information is filled in by your chosen shipping company.

Indicate whether or not your articles belong to a banned specific category, such as "articles for sale or commercial use" or "fruits, plants, seeds, meats, or birds"...