Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

- A T2L form certifies a shipment as being of EU origin, allowing it to benefit from tax exemptions.

- A T2LF document is similar to the T2L form but for goods transported between EU countries that pass through non-EU territories, such as Switzerland or Norway.

- To fill in a T2L document, you must provide exporter and consignee details and a description of the goods you're shipping, their origin, and the customs office within the EU where they were dispatched.

What is a T2L document?

A T2L document is a customs form used by international shippers to ensure the smooth flow of goods between European Union (EU) member states and associated territories, such as the Canary Islands and Andorra. It certifies the goods as being of EU origin, known as “union status”, allowing them to benefit from preferential treatment, such as exemption or reduced duties when moving across borders.

Accurate completion of a T2L form is essential, as incorrect or missing information may lead to customs delays and additional fees. Necessary details include information about the exporter and consignee, a description of the goods and their commodity codes and the mode(s) of transport.

Once completed and stamped by customs authorities in the EU departure country, the T2L document confirms the EU origin of the goods for customs purposes.

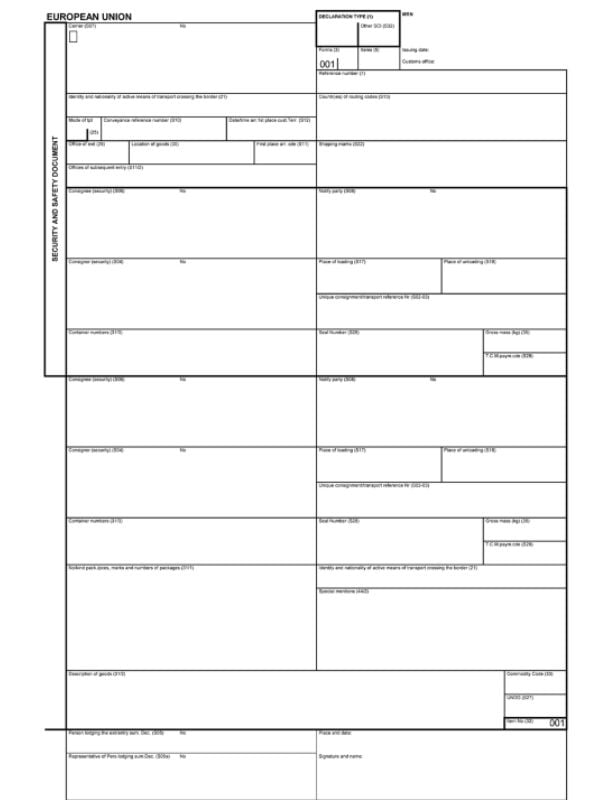

T2L document sample

Below is a sample of the T2L customs form for importing goods into Europe.

The "F" in T2LF stands for "Frontier", indicating when goods cross into new frontiers (non-EU areas) before re-entering the EU customs zone.

What is a T2LF document?

A T2LF document is similar to a T2L document but specifically for goods transported within the EU and certain non-EU territories. For instance, if goods are being moved from one EU country to another but pass through Switzerland or Norway, which are outside the European Union Customs Union (EUCU), a T2LF form is required.

The “F” in T2LF stands for “Frontier”, indicating when goods cross into new frontiers (non-EU areas) before re-entering the EU customs zone. Like the T2L, the T2LF certifies that the goods are of European origin, allowing them to qualify for reduced or no tariffs when re-entering the EU customs area.

Failure to use the correct form or incorrect completion could result in customs delays, fines or unnecessary duties. Customs authorities must stamp the form to guarantee that the goods maintain their EU-origin status during transit. Notable European nations not in the EUCU include:

- Switzerland: although Switzerland has numerous bilateral agreements with the EU, it is not part of the Customs Union.

- United Kingdom: after the Brexit referendum in June 2016, the UK officially left the EU and the Customs Union in January 2020.

- Norway: despite being a member of the European Economic Area (EEA), which includes access to the EU single market, Norway is not in the Customs Union.

- Iceland: like Norway, Iceland is part of the EEA but outside the EUCU.

- Liechtenstein: also part of the EEA but not in the EUCU.

What's the difference between a T2L and a T2LF?

The main difference between a T2L and a T2LF document is their use. A T2L is used to certify that goods are of EU origin when transported within the EU or to certain associated territories. A T2LF document, on the other hand, is used when goods are transported between EU countries but pass through non-EU territories, such as Switzerland or Norway.

While both forms prove EU origin, the T2LF is essential for maintaining union status when goods transit through non-EU areas.

As of 1st March 2024, both T2L and T2LF forms must be declared electronically by shipping companies or customs brokers on the new EU Proof of Union Status (POUS) portal, replacing the former paper-based process.

How to fill in a T2L document

Filling in a T2L document involves several essential steps to ensure accuracy and EUCU compliance, including providing the following information:

- Exporter details: the name, address and contact details of the shipper or their representative.

- Consignee details: the name and address of the recipient within the EU or associated territory.

- Description of goods: detailed information about the goods you're shipping, including their nature, quantity, weight (net and gross), value and applicable commodity codes.

- Origin of goods: the country where the goods were manufactured or purchased.

- Departure customs office: the customs office within the EU where the goods were dispatched.

Once issued, T2L documents remain valid for ninety days.

When goods arrive at an EU checkpoint, the exporter must submit the T2L document to customs authorities for inspection. Both the exporter and the customs authorities must retain copies as part of their records.

T2L form countries

The following is a list of countries and territories where a T2L form is typically needed:

- All 27 EU countries, including France, Germany, Spain, Portugal, Ireland, Italy, Poland, Romania and Sweden.

- Associated territories, including the Canary Islands (Spain), Guadeloupe, Martinique, Mayotte, Réunion (French overseas territories), French Guiana, Aland Islands (Finland), Mount Athos (Greece), San Marino and Andorra (for industrial goods).

And here is a list of countries where a T2LF form is required:

- Switzerland

- Norway

- Iceland

- Liechtenstein

- Andorra (for agricultural goods)

- San Marino (only if the goods are transitioning through non-EU territories)