Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

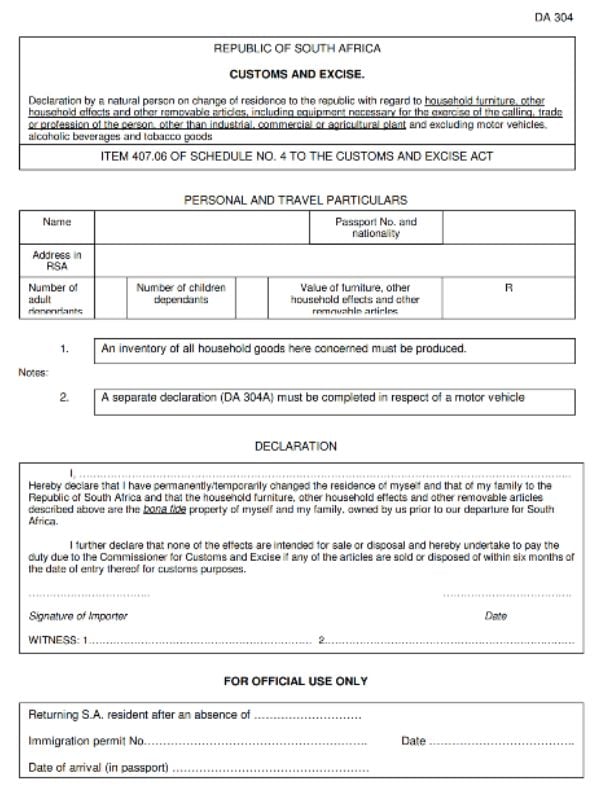

- A DA304 is a mandatory customs declaration form anyone wishing to import personal belongings into South Africa must complete. In contrast, a P1.160 form is used when importing unaccompanied household effects into the country.

- If they meet specific criteria, returning South Africans and foreign nationals moving to the country for work or permanent residence can receive duty-free imports with a DA304 form.

- To complete a DA304 South Africa customs declaration, you must provide personal information such as name, address, and passport number, an inventory listing what you're shipping, and a signed statement.

Accuracy is crucial, as discrepancies could lead to delays or additional charges...

What is a DA304?

A DA304 is a mandatory customs declaration form for importing personal effects and household goods into South Africa. It covers all items used to equip a home, such as electrical goods, linen and kitchenware. Individuals relocating to South Africa or returning residents bringing personal belongings into the country must complete a DA304.

This document requires you to provide details about the goods, ensuring they comply with South African customs and import regulations. The DA304 form also helps customs officials determine whether additional documentation is needed, such as permits for restricted items and if the goods are subject to inspection. Accuracy is crucial, as discrepancies could lead to delays or additional charges, particularly if officials decide to inspect your shipment.

What is a P1.160?

A P1.160 is a declaration form used when importing unaccompanied household effects into South Africa, focusing on restricted or prohibited personal goods. Ensuring compliance with South African customs regulations is vital, particularly for returning residents or individuals relocating to the country.

The form is essential for items requiring additional scrutiny, such as firearms, alcohol, foodstuffs or plants. The P1.160 helps identify and address potential risks before customs clear the goods, complementing the DA304's broader focus on the entire shipment.

Check the official South African Revenue Service website for the most up-to-date news on restricted imports.

South Africa customs declaration DA304 sample

Below is a sample of the customs form DA304 (please note this is not the P1.160 form).

What do you have to declare at customs South Africa?

When entering South Africa, you must declare all unaccompanied personal effects, household goods and any items of value you are bringing into the country. A packing list detailing the contents of your shipment is mandatory, and South African customs officials will review it upon arrival.

Additionally, motor vehicles, electronic goods, and other controlled items may require special documentation or licences. Certain items, including narcotics, large sums of money, specific animals and prohibited goods, cannot be imported.

Failure to declare everything you are shipping may result in penalties or delays. The DA304 and P1.160 forms help facilitate a smooth declaration process.

Refer to the South African Revenue Service website for a complete list of prohibited goods.

When shipping to South Africa, wedding trousseau and new items like furniture and clothing are subject to full customs duties.

How to fill in a DA304 South Africa customs declaration

Filling in a DA304 requires accurate information about the imported goods, including their value. You'll also need to provide supporting documents, such as a packing list and proof of ownership. Ensuring all information is accurate is essential, as any discrepancies could lead to delays or additional charges.

Here's how to fill out each section of a DA304 form:

Personal and travel particulars

- Name: your full legal name as it appears on your passport.

- Passport number: ensure it matches the passport used to travel.

- Address: provide your South African address.

- Nationality: indicate your nationality as stated on your passport.

- Number of adult dependents: list how many adults you are financially responsible for, such as a spouse.

- Number of child dependants: list how many children you are financially responsible for.

- Value of furniture and household goods: declare the current value of your used or new household goods, including furniture, appliances and other personal effects.

- Inventory: provide a detailed packing list of all household goods in the shipment, including descriptions, condition (whether used or new), and the estimated value of each item.

Declaration

- Statement: write your name and declare if you are permanently or temporarily moving to South Africa and that all household goods are your property, were owned before your departure, and will not be sold or disposed of within six months of import.

- Sign and date: add your signature and the date in the space provided. Two witnesses must also sign the form to verify your declaration.

If importing a motor vehicle, you must complete a separate DA304A form.

The DA304 form is a legally binding declaration, so ensure all information is accurate. If in doubt, seek advice from your chosen international shipping company.

DA304: Who is eligible for duty-free imports to South Africa?

Returning residents and foreign nationals moving to South Africa for work or permanent residence can receive duty-free imports with a DA304 form if they meet specific criteria. Diplomats can also qualify for duty-free status. However, tourists or visitors (even those with pending work or residency applications) do not qualify for duty-free importation.

To receive customs exemption on personal effects and household goods when importing into South Africa, the following conditions must apply:

- Returning nationals must have lived outside South Africa for at least six continuous months,

- Foreign nationals must prove they have the right to live and work in South Africa for at least six months by obtaining a permanent residence document or work permit,

- The shipment owner must be in South Africa at least 10 days before the shipment arrives,

- Customs forms DA304 and P1.160 must be completed and submitted for processing,

- You must not sell or dispose of your goods within six months after importation,

- The goods must be used personal or household effects,

- The importer must provide a detailed inventory of all items.

Diplomatic personnel can receive exemptions if they can provide the following documentation:

- A diplomatic clearance certificate,

- A detailed inventory,

- A certificate from an embassy in South Africa, countersigned by the South African Department of Foreign Affairs.