Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

- Form RD-0030E is a Norwegian customs form anyone wishing to import personal belongings into the country must complete.

- This document helps customs officials monitor what is entering Norway and allows you to import household items tax-free.

- To fill out customs form RD-0030E, you must provide your personal details, an inventory listing what you're shipping and declare any goods that might be subject to duties or require a permit to ship, such as weapons or pets.

What is Norway customs declaration form RD-0030E?

Form RD-0030E is a mandatory customs declaration for importing personal effects and household items when moving to Norway. The shipment owner must sign and submit it to Norwegian Customs, who can only clear the goods once the declaration is complete.

The form ensures that all items comply with Norwegian customs regulations and helps authorities monitor what is entering the country for legal and security purposes. If a third party, such as an international removals company, is handling the shipment, they will need a signed Power of Attorney from the owner to submit the RD-0030E, allowing the shipment to be processed even if the owner is absent during customs clearance.

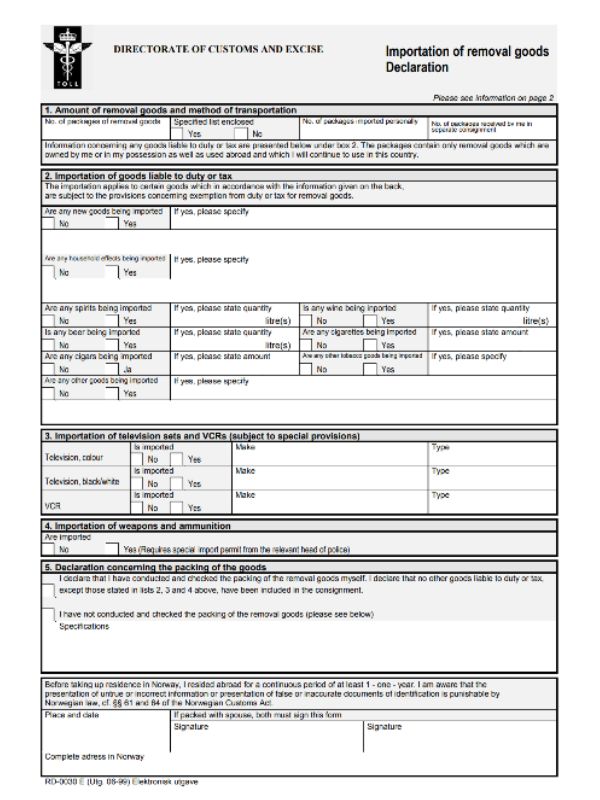

RD-0030E sample

Below is a sample of the Norwegian customs form RD-0030E.

Do I need a customs form for Norway?

Anyone importing goods to Norway, particularly when relocating and bringing household effects, must complete the customs form RD-0030E. This document is crucial for allowing relief from customs duties and taxes on used household goods.

You may be eligible for customs and duty exemption, provided you meet the following conditions:

- You have lived outside Norway for at least 12 continuous months,

- You complete an inventory listing everything in your shipment,

- You own and have used the items while living abroad and will continue to use them after arriving in Norway,

- You are importing the items as part of a relocation to Norway,

- You must import your belongings into Norway within a 'reasonable time', no longer than one year.

If you are temporarily (up to a year) moving to Norway for work, you can import professional equipment, samples, advertising materials and more duty-free using an ATA carnet.

Not all goods, such as motor vehicles, food, alcohol, and tobacco, are exempt from customs duties, and some items are banned from importation or may need specific permits or licenses. Before packing, refer to the official Norwegian Customs website for the latest information.

How to fill out Norway customs form RD-0030E

The person shipping household goods into Norway must fill out and sign an RD-0030E form and submit it to Norwegian Customs. They must intend to make Norway their home and use the goods upon arrival.

Here's how to fill out each section of an RD-0030E form:

- Personal data: enter your name, email address, home address in Norway and abroad, and Norwegian National Identity Number (or D-number/TRK No. if applicable).

- Volume of personal and household effects: list and describe the total number of items you are shipping, separating what will arrive with you and what will arrive later.

- Goods subject to customs duties: state if you have unused/new items, consumables, alcohol, tobacco, or other dutiable goods like vehicles or work tools, including quantity and details.

- Weapons and ammunition: declare any firearms or ammunition and whether you have the required import permit.

- Animals: specify if you are bringing a pet and whether you have the required documentation.

- Other goods/items subject to restrictions: declare if you have items that need special permits (e.g., if you're shipping endangered species, medicines).

- Enclosures: list any additional enclosures (e.g., inventory lists or additional documentation).

- Packing: declare whether you packed the goods or if someone else did.

- Additional information: include any other relevant details, such as whether you are shipping currency.

- Declaration: sign and date the form, confirming that you meet the eligibility requirements and understand the legal implications of providing false information.

For further guidance, go to Tolletaten, the Norwegian Customs official website.

This document is crucial for allowing relief from customs duties and taxes on used household goods.