Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

- The New Zealand customs declaration form NZCS 218 is a mandatory document all new immigrants and returning citizens shipping unaccompanied household effects into NZ must complete for tax-free importation.

- The MPI personal effects declaration is a supplementary form issued by New Zealand's Ministry for Primary Industries (MPI) for those shipping items into the country that may be a biosecurity risk.

- Fill out a New Zealand customs declaration form by providing details such as the lead shipment owner's personal information, when you plan to arrive in NZ, a list of what you're sending and a shipping reference number.

What is a New Zealand customs form NZCS 218?

The New Zealand customs declaration form NZCS 218 is a mandatory document for all new immigrants and returning citizens shipping unaccompanied household effects into New Zealand. As defined by the New Zealand Customs Service, household effects include kitchenware, furniture, household tools, kitchen appliances, linen, personal computers, sporting equipment and musical instruments.

The primary purpose of a NZCS 218 form is to protect New Zealand's borders from potential risks, such as biosecurity hazards and the importation of illegal substances and other restricted items. When moving to New Zealand, you may qualify for a household effects concession if you meet specific criteria. Otherwise, you'll be liable to pay Goods and Services Tax (GST) of 15% of the total value of all items.

You must be present in New Zealand before your goods arrive and provide detailed information about all imported items, their origins and their owner's recent travel history.

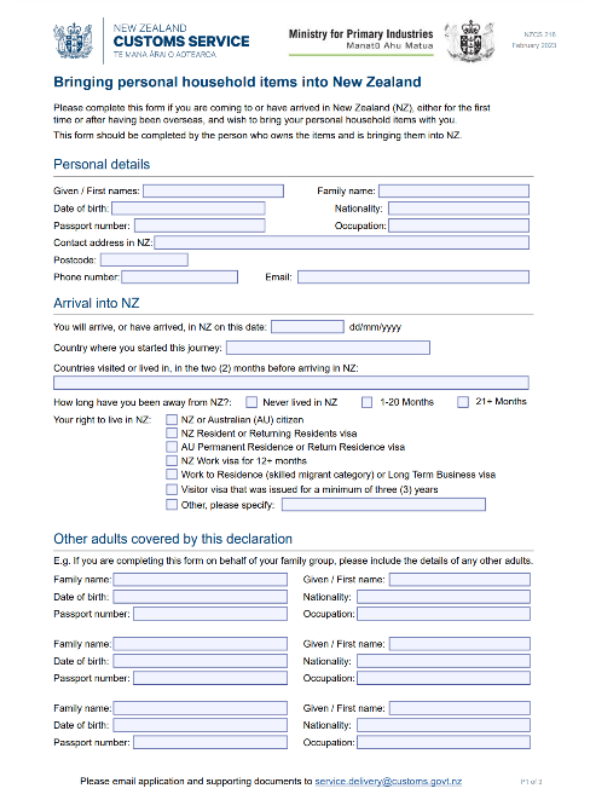

NZCS 218 declaration form sample

Below is a sample of the NZ customs form. It's only available in English; however, the official New Zealand Customs Service website has a language resource section.

What is the MPI personal effects declaration?

The MPI personal effects declaration is a supplementary form issued by New Zealand's Ministry for Primary Industries (MPI) for those shipping personal belongings into NZ that may be a biosecurity risk.

It includes questions about whether the importer has packed food, traditional medicines, garden equipment, bicycles, pet and animal equipment, Christmas decorations, machinery, and more. It also asks if you have cleaned all items to remove contaminants such as soil or plant material.

While not mandatory, completing the form may help avoid additional inspections and costs. The importer must sign the declaration, which confirms the truthfulness and accuracy of all information provided.

You have five years after your arrival in New Zealand to claim concessions on qualifying household effects. After this period, concessions are at the discretion of New Zealand Customs Officers.

How to fill out a New Zealand customs declaration form

Completing a New Zealand Customs Declaration NZCS 218 form requires careful attention to detail to ensure accuracy. Failure to complete the form correctly could result in fines, confiscation of items or even prosecution.

A NZCS 218 form is three pages long and asks for in-depth details about you (and your travelling party), your travel plans and exactly what you're shipping. Typically, the removal company that ships your belongings will require you to fill out this form before shipping. Some companies will ask you to complete this online, and the information you enter will generate a form that is presented to the New Zealand authorities when your belongings arrive.

Follow our step-by-step guide below or check the official NZ Customs Service website for more details.

Page 1

Personal details: enter the lead shipment owner's full name, contact details, passport number and other personal information.

Arrival into New Zealand: provide your arrival date, origin country and time spent outside NZ, and identify your right to residence.

Other adults covered by this declaration: if travelling as a group, include the name, nationality and occupation of all members.

Page 2

Items information: list all personal and household items you're shipping, including type, quantity, condition (new or used), resale value in NZ, purpose and more.

Shipping reference number: include the identifying reference number provided by your shipping company, usually found on your quote PDF or job confirmation email.

Page 3

Biosecurity questions: declare if you're shipping items that pose a biosecurity risk, such as food, plants, animal products, and outdoor equipment, including footwear, bicycles and camping equipment.

Supporting documents: sign and date the form to confirm accuracy (you can use a digital signature).

Do I have to pay customs on personal items?

To receive a concession on the unaccompanied household effects you're shipping into New Zealand with a NZCS 218 form, you must meet the following criteria:

- Prove your authorisation to reside in New Zealand using one of the following documents:

- A New Zealand passport,

- An Australian passport,

- A New Zealand residence visa or permit,

- A current returning resident's visa or permit,

- A current permanent residence visa,

- A work visa or work permit issued for at least one year,

- A work visa or work permit, issued under the Work to Residence (Skilled Migrant Category) policy or the Long Term Business Visa/Permit category,

- A visitor's visa or permit issued for a minimum of three years.

- Have lived outside New Zealand for twenty-one months before your arrival.

- You have owned and used your household effects before arriving in NZ.

- Your household effects must be for personal use, not gifted, exchanged or sold.

You must declare all goods shipping to NZ, including brand-new items and those you intend to sell or gift, as GST will apply.

Students are ineligible for a full concession. However, concessions are available for specific items essential to your studies, such as a desk, a laptop and textbooks.