Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

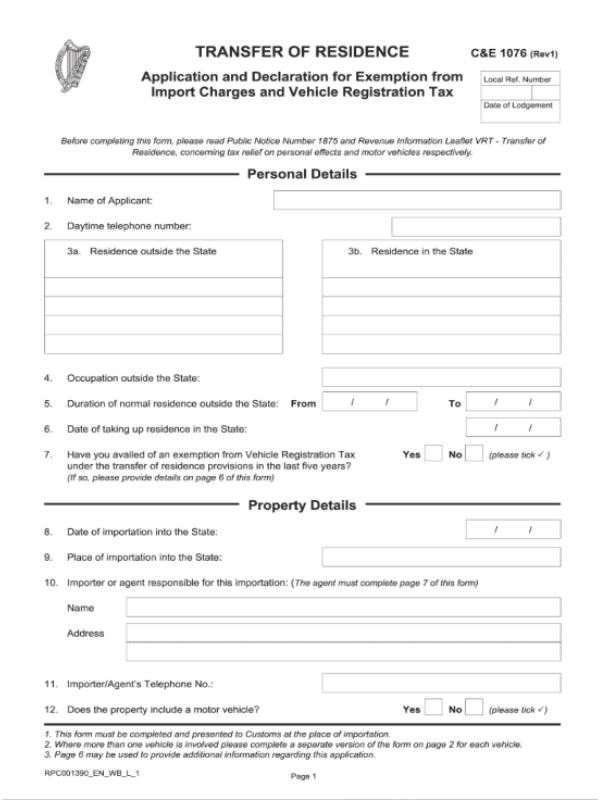

- The Irish customs declaration form C&E 1076 is a mandatory document used during the Transfer of Residence (TOR) process by those moving from outside the EU to Ireland for the tax-free importation of household effects.

- To be eligible for tax relief using a C&E 1076 form, you must be moving from outside the EU, have paid the taxes on the items in your country of purchase, and owned them for at least six months.

- Fill out a C&E 1076 form by providing proof of your residence abroad, your plan to move to Ireland and your ownership of the items.

What is a C&E 1076 customs declaration?

A C&E 1076 customs declaration is a form used during the Transfer of Residence (TOR) process by those moving from outside the European Union (EU) to Ireland. It helps Irish customs officials track and manage the tax relief on all imported personal goods.

Completing a C&E 1076 ensures that items, including vehicles, aren't subject to customs duties and Value Added Tax (VAT), provided they meet specific criteria, such as being in use for six months before the move.

You must submit your completed C&E 1076 form to the Irish government agency Revenue Commissioners, known simply as Revenue, at least two weeks before the goods arrive in Ireland.

C&E 1076 sample

Below is a sample of the Ireland customs form.

You cannot loan, hire out, sell or dispose of your goods within twelve months of your move to Ireland.

C&E 1076: who is eligible for tax-free imports to Ireland?

To be eligible for tax-free imports using a C&E 1076 form, you must meet the following conditions:

- You must be moving from outside one of the twenty-seven EU member states (where you have lived for at least 12 consecutive months) to reside in Ireland. Exceptions apply if you can prove you intended to live outside the EU for a continuous year.

- Your goods must have duties and taxes already paid in their country of purchase.

- Your goods must have been in your possession and used for at least six months before your arrival in Ireland.

- You cannot loan, hire out, sell or dispose of your goods within twelve months of your move to Ireland.

- You must import your goods within six months before or twelve months after your move.

- You must import wedding trousseau (bride and groom clothing, linen and other belongings used for a wedding) and wedding gifts (relief only applies to gifts under €1,000 (around US$1,083)) two months before or four months after the marriage.

There is no customs or VAT relief for the following:

- Alcohol products,

- Tobacco products,

- Trade tools,

- Commercial vehicles,

- Commercial property.

If you're shipping personal belongings from an EU country to Ireland, you do not need to pay VAT or customs duty, as you've already paid these fees in the member state where you bought the items.

How to fill out a C&E 1076 form

When completing the C&E 1076 form, items of significant value, such as electronics or vehicles, must include an estimated current market value.

Additionally, those bringing a vehicle may need to complete a separate form for Vehicle Registration Tax (VRT).

Below are the supporting documents you'll need when completing a C&E 1076 form:

- For your residence abroad: proof of purchase or rental of property, proof of cessation of employment.

- Proof of day-to-day living abroad: utility bills, bank statements, school records (if applicable), etc.

- For your move to Ireland: proof of purchase or rental of property, an employment contract.

- Ownership and use of the items you are shipping: invoices and receipts.

You or your chosen shipping company should submit the completed form and supporting documents to Revenue two weeks before your goods arrive in Ireland.

For the most up-to-date information, contact the Irish Authorisations and Reliefs Unit.