Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

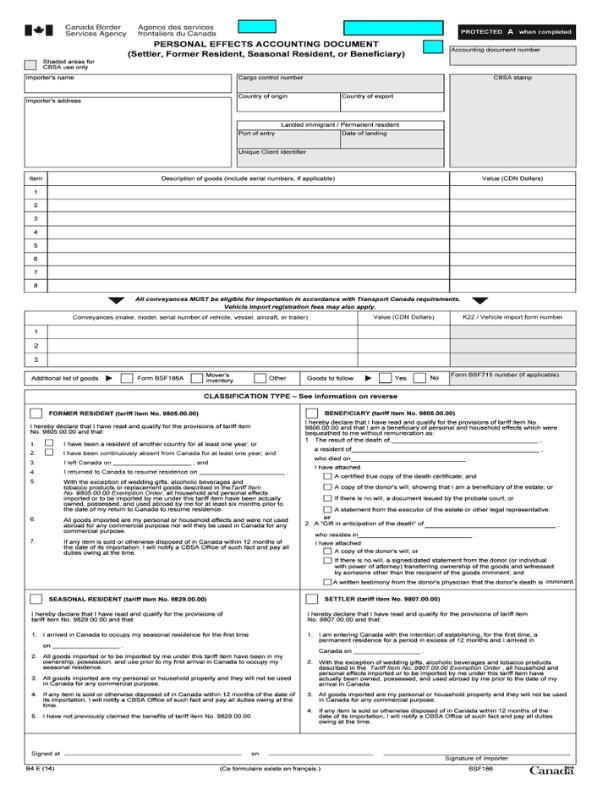

- The Canada customs form BSF186 is a mandatory document for those returning or moving to Canada as permanent residents that allows the duty-free importation of personal effects.

- A BSF186 form is for the goods you bring with you at the time of entry, such as the suitcases you take on the flight, whereas the BSF186A is a supplementary form for goods-to-follow.

- Those eligible for tax relief with a BSF186 form include new immigrants moving to Canada for the first time, returning nationals and individuals entering Canada for time-defined work, study, or other approved purposes.

What is the Canada customs form BSF186?

The Canada customs form BSF186 is a mandatory document for those returning or moving to Canada as a new permanent resident, allowing the duty-free importation of personal effects (as long as they have been in your possession for at least six months). This form is also known as a Personal Effects Accounting Document (PEAD) or, more commonly, a B4.

Once complete, it allows the Canada Border Services Agency (CBSA) to assess whether or not you can import duty-free eligible goods, such as furniture, kitchen appliances, clothing and other personal items not intended for resale. You must present it at your first point of entry in Canada, where a CBSA officer will review and stamp it — even if this point is a layover stop in Canada on your way to your final Canadian destination.

The BSF186 form includes sections on personal information, an itemised list of all goods, and details on any imported vehicles. It also includes a section to declare additional goods that arrive separately, which you can list using an accompanying BSF186A form.

It's advisable to prepare both documents before you travel. Doing so ensures all necessary information is accurately captured for a hassle-free entry into Canada and avoids delays or fines.

Canada customs declaration form sample

You can download a BSF186 form and a BSF186A form directly from the CBA website.

To qualify for duty-free importation, eligible individuals must declare that their household and personal effects are for personal use, not resale.

What's the difference between a BSF186 form and a BSF186A?

The BSF186 and BSF186A forms are both used to declare personal and household goods when moving to Canada for at least a year, but they serve different purposes:

BSF186 form (or B4)

This form is for the goods you bring with you at the time of entry, such as the suitcases you take on the flight. You must complete this form even if you have no goods with you upon arrival.

BSF186A (or B4A)

This is a supplementary form for goods-to-follow, items that arrive separately at a later date and are typically transported by an international removals company.

Who is eligible for tax relief with a BSF186 form?

Tax relief using BSF186 and BSF186A forms are only available to those who meet specific criteria, including:

- New immigrants: those moving to Canada for the first time to take up permanent residence.

- Returning citizens: Canadian nationals or permanent residents returning after living overseas for at least one year.

- Temporary residents: individuals entering Canada for time-defined work, study, or other approved purposes, such as family reunification or diplomatic assignments.

To qualify for duty-free importation, eligible individuals must declare that their household and personal effects are for personal use, not resale.

Ineligible groups include temporary residents on short-term permits, tourists, those using transit visas, and anyone who plans to sell or resell their belongings.

There is no penalty for not shipping an item detailed on your B4A form. Outlining it on the goods-to-follow list allows you to ship it in the future and ensures you avoid taxes when you do bring it to Canada.

How to fill out customs form for Canada

Filling out a BSF186 form includes several vital steps to ensure accuracy and compliance with Canadian customs regulations. You can follow the detailed instructions on the official CBSA website.

Key sections include:

- Importer's information: your name, country of origin, address in Canada and arrival date.

- Description of goods: a list of imported items, including descriptions, serial numbers, and their value in Canadian dollars. You can categorise similar items, such as clothing, into one line and then include extra pages with the details of the items in each category. For jewellery, use the wording from your insurance policy or a jeweller's appraisal as a description, and include photographs.

- Conveyances: here, you provide the make, model, and serial number of any vehicles, vessels, aircraft, or trailers you're importing. Leave this section blank or write "N/A" in the cells if you are not importing vehicles.

- Classification type: indicate whether you are a former resident, beneficiary, seasonal resident or settler.

- Additional declarations: specify if you have goods to follow and provide a completed BSF186A form (if applicable).

Handwrite your signature and the date at the bottom of both documents to acknowledge responsibility for an accurate declaration and possible duties.

The following fields (shaded in grey on the document) should be left blank for the CBSA officer to fill in:

- Accounting document number

- CBSA stamp

- Cargo control number

- Port of entry

- Date of landing

- Unique Client Identifier (UCI)

Remember, don't pack these documents in your luggage — keep them on your person or in your carry-on bag for a seamless customs clearance experience.

Also note that as a strict rule of Canadian customs, you must arrive in Canada before your belongings if you are sending them separately. However, once you have the form B186A stamped, there is no time limit on importing your goods to Canada.

What goods can enter Canada tax-free with a BSF186 form?

The following are examples of typical unaccompanied personal and household items you can ship duty-free into Canada using BSF186 and BSF186A forms (if eligible):

- Clothing and footwear

- Electronics (e.g. laptops, phones and TVs)

- Kitchen appliances (e.g. refrigerators and ovens)

- Furniture (e.g. sofas, beds and tables)

- Books

- Decorative items (e.g. vases and wall art)

- Bedding and linen

- Personal bathroom toiletries

- Toys and games

- Musical instruments

- Sporting equipment

- Tools and hardware

- Cooking utensils

- Small kitchen appliances (e.g. coffee pots and toasters)

Reference the CBSA website for a detailed list of all eligible goods.

Items subject to customs duty:

- Motorised vehicles for business use

- Items you do not own

- Alcohol

- Tobacco

- Farming equipment

- Gifts that exceed CAD60 (around USD44)

- Construction and manufacturing equipment

Please check our Prohibited Goods page for a detailed list of items banned from being imported into Canada to protect their citizens and environment.