Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

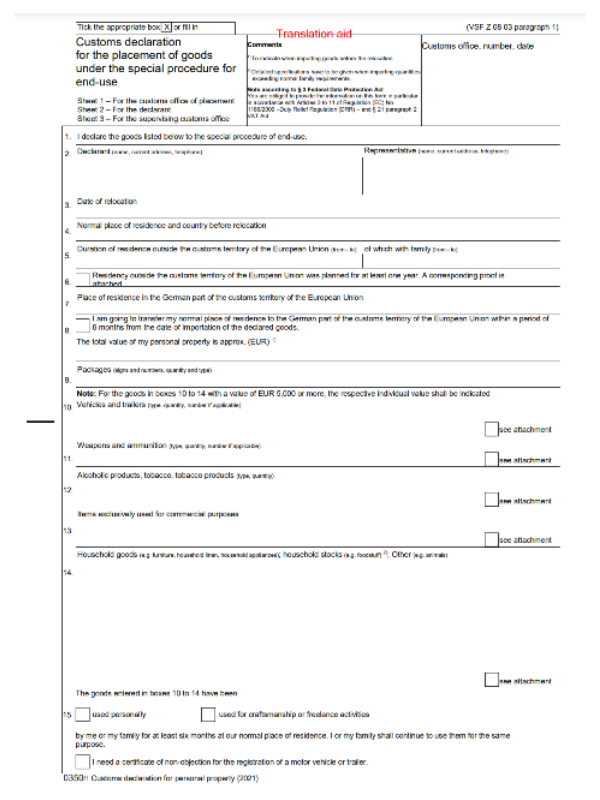

- The German customs declaration form 0350 is a mandatory document that new and returning German citizens must complete to import "personal property" from non-EU countries into the country tax-free.

- To be eligible for tax relief using a 0350 form, you must have lived outside the EU for 12 months, established a new place of residence in Germany before applying and owned the goods you're sending for at least six months.

- Fill out a German customs form by providing the information needed in the nineteen sections of the application you must complete and sign the declaration.

What is the German customs declaration form 0350?

The German customs declaration form 0350, commonly known as "Zollanmeldung" (German for "customs declaration"), is a required document for importing "personal property" into Germany from non-EU countries. Zoll issues it, the official German Customs authority.

Personal property is a broad term for personal effects that encompasses household goods such as furniture, linen, vehicles, pets, instruments and equipment, none of which may be intended for resale in Germany.

Completing a 0350 form allows new and returning German residents to declare the nature, quantity, value and origin of the goods they wish to import. It also lets Zoll ensure compliance with trade regulations, calculate duties and taxes, and prevent illegal and unwanted goods from entering Germany, protecting the country's people and environment.

When moving to Germany, you may be able to import all your items duty-free, provided specific criteria are met, such as having lived outside the European Union (EU) for at least a year and planning to take up permanent residence in Germany.

0350 customs form sample

Below is a sample of the German customs form. It's only available in German; however, guidance is available in English.

Your usual residence outside the EU must have lasted at least twelve months...

Who is eligible for duty-free imports via the 0350 form?

To import personal property into Germany customs duty-free using the form 0350, you must meet the following criteria:

- Your usual residence outside the EU must have lasted at least twelve months, with exceptions possible if you can prove your intentions (e.g., evidence of an employment contract).

- You must establish a new place of residence in Germany before applying for customs relief.

- The goods must have been in your possession and used for at least six months before moving to the EU, with proof via invoices or sales contracts.

- You must use your belongings for the same purpose as before residency in Germany.

- You must intend to use your goods for personal use only and not lend, hire or sell them within your first year in Germany.

- Vehicles or aircraft must be registered in your name and supported by documents from foreign authorities.

You can only claim duty-free clearance within twelve months of relocating to Germany, and you must submit your customs declaration alongside your goods' importation.

How to fill out a German customs form

Filling out a German customs declaration form requires close attention to detail and compliance with customs regulations over several steps. Typically, the international removals experts that ship your possessions will require you to complete this form before shipping, often using their version of a 0350 form.

It is two pages long, with thirty sections to fill in, nineteen of which you must complete. The remaining eleven sections are for the German customs official to complete.

Follow our guide below or check the official German Customs Authority website for further details.

Start by providing personal details, including your name, current address, how long you've lived there and your telephone number. You'll also need to specify the date of your relocation to Germany.

Next, include information about your previous home, such as your usual country of residence before moving. You must state how long you lived outside the EU and attach proof that it was planned for at least one year. Accepted proof includes a letter from the German Embassy, a tenancy agreement or an employment contract.

For your new home, provide your German address and confirm that you'll transfer your residence to Germany within six months of importing your goods.

Then, list all household goods (furniture, clothing, etc.) and household stocks (foodstuff) and information about any vehicles, trailers, weapons, ammunition, alcoholic products, tobacco and items used exclusively for commercial purposes. Specify any items with a value of €5,000 or more. Declare whether the goods listed have been used personally or for craftsmanship or freelance activities, and provide the total value of your personal property in euros.

Finally, sign the declaration, confirming that all the information provided is accurate and complete.

You must state how long you lived outside the EU and attach proof that it was planned for at least one year.