Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

- An 18.44 form is a mandatory customs declaration document anyone wishing to import personal belongings into Switzerland must complete.

- If they meet specific criteria, returning Swiss citizens and foreign nationals moving to the country for work or permanent residence can receive duty-free imports with an 18.44 form.

- To complete a Swiss 18.44 form customs declaration, you must provide personal information, state your import purpose, confirm you've owned the items for six months, and list all the goods you wish to ship.

What is Swiss customs declaration form 18.44?

Swiss customs declaration form 18.44 is an official document used by new immigrants applying for customs duties exemption on used personal belongings and household effects as part of their move to Switzerland. Accurate completion of form 18.44 ensures that all household goods meet specific customs conditions and regulations, streamlines the import process and protects Switzerland's borders from banned or restricted items.

The customs form covers a wide range of household effects, including personal effects, furniture, animals and vehicles, as long as they have been used for at least six months. If you import your household items in multiple stages, the first declaration should include a note of additional shipments expected later. When importing a vehicle to Switzerland, you must declare it immediately and include its foreign registration certificate and contract of sale (receipt).

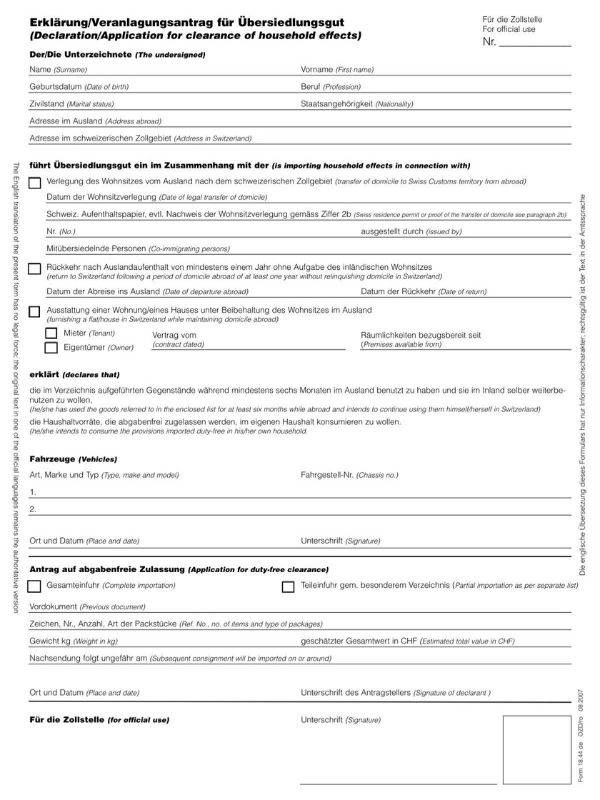

Swiss customs form 18.44 sample

Below is a sample of the Swiss customs form in German, with English translations for each section.

You or your international shipping company must present an original signed form 18.44 to a Swiss customs office — copies or PDFs are not accepted. Refer to the official Switzerland Federal Office for Customs and Border Security for the most up-to-date customs rules and regulations.

How to complete form 18.44

Completing form 18.44 requires specific details about the shipment owner and the items you import to Switzerland to ensure a smooth customs clearance process.

Follow these steps to fill in a Swiss customs declaration form 18.44 successfully:

- Personal information: include your first name, surname, date of birth, profession, marital status, nationality, and address in Switzerland and overseas.

- Purpose of import: indicate your reason for importing household goods as either a new immigrant, returning Swiss national or if you're furnishing a home in Switzerland while maintaining a property abroad.

- Declaration of items: confirm whether you have used and owned your items for at least six months abroad and intend to continue using them in Switzerland.

- Import details: indicate if your shipment is complete or partial (with a separate list for shipments arriving later) and provide the number and type of packages, total weight in kilograms, and estimated total value in Swiss Francs.

- Documentation: include a packing list of all items and any relevant documents, such as residence permits and vehicle registration.

- Sign: write your signature, your current location and the completion date.

Who is eligible for tax-free importing to Switzerland?

To be eligible for tax-free imports using a form 18.44, you must meet the following conditions:

All immigrants

- Provide a complete, signed customs form 18.44.

- Provide a copy of your passport's picture page.

- Provide a packing list of every item you import in German, French, Italian or English.

- Provide a countersigned copy of your Swiss property's lease or ownership title.

- Provide a copy of a registration certificate from the local town hall.

- You must have owned and possessed your items for at least six months before your arrival in Switzerland.

- You must import your items within two years of your arrival in Switzerland.

- If you have more than one shipment, you must announce them all during your first importation.

Additional conditions for EU members

- Provide a copy of your residence permit, an approval letter from your local immigration office, or a countersigned employment contract from a Swiss employer.

Additional conditions for non-EU members

- Provide a copy of your residence permit or an approval letter from your local immigration office.

- Provide a countersigned employment contract from a Swiss employer.

Swiss customs officials may request further documents, such as proof that you have left your foreign residence. Students can import student and household effects duty-free, even if they do not make Switzerland their new domicile.