Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

- Completing a TV 740.47 allows returning Swedish citizens and new immigrants who have lived outside the EU for at least one year to import their personal goods, vehicles and household items duty-free.

- Customs clearance for Sweden can happen relatively quickly if all paperwork, including form TV 74.47, proof of ownership and a packing list, is in order.

- To complete form TV 740.47, you must provide personal information, indicate your citizenship, state why you are moving to Sweden, list the items you are shipping and prove ownership.

To qualify for duty-free imports, applicants must have resided in a non-EU country for at least one continuous year...

What is Sweden customs clearance form TV 740.47?

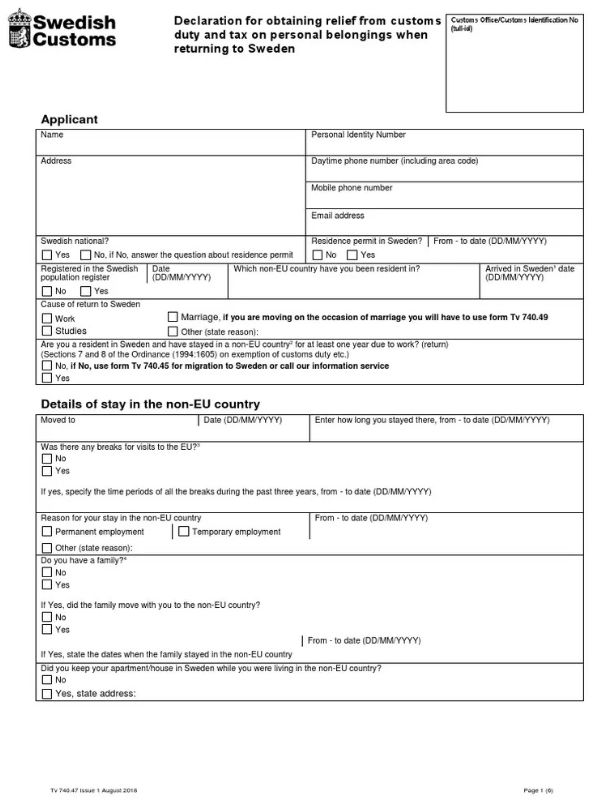

Form TV 740.47 is a customs clearance document required by individuals importing personal effects and household belongings from a non-EU country to Sweden. It helps Swedish Customs calculate any applicable customs duties and taxes and confirm that the goods are personal effects or commercial items.

Completing a TV 740.47 allows returning Swedish citizens and new immigrants who have lived outside the EU for at least one year to import their personal goods, vehicles and household items without paying import duties.

To qualify for duty-free imports, applicants must have resided in a non-EU country for at least one continuous year, used the items personally for at least six months and intend to use them in Sweden.

You must also supply supporting documents proving ownership, usage, and when you plan to move to Sweden. The importer must present a completed TV 740.47 form to Swedish Customs at the time of clearance.

How long does customs clearance take for Sweden?

Customs clearance can take from a few hours to a few weeks for Sweden, depending on several factors. Generally, once goods arrive at a customs office, they enter temporary storage, lasting up to 90 days. During this time, Swedish customs authorities review the documentation and decide on the appropriate procedure for the goods.

If all paperwork, including form TV 74.47, proof of ownership and a packing list, is in order, clearance and customs duties exemption, if applicable, can happen relatively quickly. However, any mistakes or missing documentation can lead to delays.

The value and nature of the goods can also affect clearance times, with high-value items attracting more scrutiny and potentially lengthening the process. Customs officers may also assess whether the goods comply with Swedish import regulations, especially for items subject to safety or environmental standards.

There is no customs relief for beer, spirits, wines or tobacco products when shipping to Sweden.

How to fill in a TV 740.47 customs form

Completing a TV 740.47 form for Swedish imports requires specific details about the shipment owner and the goods you are shipping to ensure a smooth customs clearance process.

To fill in a TV 740.47 customs form as an immigrant or returning citizen to Sweden, follow these steps:

- Applicant information: provide personal details, including your name, identity number, address and contact information.

- Citizenship and residence: indicate your citizenship and answer questions about your residence permit, registration in Sweden, previous country of residence, and the date you arrived in Sweden.

- Reason for immigration: state why you are moving to Sweden, e.g., for work, marriage, or studies, and provide relevant details about your stay outside the EU.

- Family: indicate whether you are arriving with family members and if they accompanied you while outside the EU.

- Shipment information: enter import details, including the date, whether your shipment contains restricted goods, and a packing list of all items with descriptions, quantities and values.

- Ownership and use: indicating that the items in your shipment are your personal property for at least six months before departure and how you intend to use them in Sweden.

- Vehicle information: provide details for any vehicles you are importing, including type, make, model, purchase information, and registration details.

- Supporting documents: attach, where applicable, proof of immigration, residence outside the EU, and ownership of items.

- Declaration: sign the form to confirm that all information is accurate, including the date and your printed name.

Who is eligible for customs clearance with a TV 740.47?

Individuals eligible for customs clearance with a TV 740.47 form are typically those moving to Sweden for the first time or returning Swedish nationals.

You must meet the following conditions:

- You cannot import spirits, wines, beer and tobacco products.

- You must provide proof that you are moving to Sweden to live, such as a work permit, residence permit or other proof of residence.

- Provide a copy of your passport's photo and signature pages.

- Submit certificates proving your work status from your employer abroad and in Sweden.

- Include a bill of lading or sea waybill, typically provided by your shipping company.

- Provide a detailed packing list of all items in your shipment.

- If you are a non-EU citizen, you must be moving to Sweden for the first time.

- You must have lived outside the EU for 12 months before arriving in Sweden.

- You must own the items, have used them abroad, or plan to use them in Sweden.

- Your items must be of a reasonable quantity and suitable for use in a home.

- You must import your items within a year of moving to Sweden.

- You must intend to live in Sweden for at least one year.