Before packing, check this list of items prohibited from entering a particular country or region.

Key takeaways

- A B534 form is a mandatory customs declaration document that allows eligible visitors to ship belongings to Australia without paying customs duty or Goods and Services Tax (GST).

- To be eligible for tax relief using a B534 form, you must be arriving from a country outside Australia, meet permanent residency requirements, and have owned the goods you are sending for more than 12 months.

- Fill out a customs form for Australia by providing photocopies of your passport photo page and accurately completing all four pages of your customs statement.

What is Australian customs declaration form B534?

A B534 form, also known as an "Unaccompanied Personal Effects Statement", is a mandatory customs declaration document that allows eligible visitors to ship belongings to Australia without paying customs duty or Goods and Services Tax (GST).

Unaccompanied Personal Effects (UPEs) include household items, such as clothing, sports equipment and furniture, that you import into Australia, typically via an international removals company, and arrive separately from you.

The B534 form also helps streamline the Australian customs clearance process by minimising delays. It's part of the broader customs process managed by the Australian Border Force (ABF), which protects Australia's borders while ensuring the efficient import of personal effects.

Accurately completed B534 forms ensure your personal belongings meet Australian customs requirements. They must include accurate details about the shipment's contents, value and ownership. You can submit them either online or on paper.

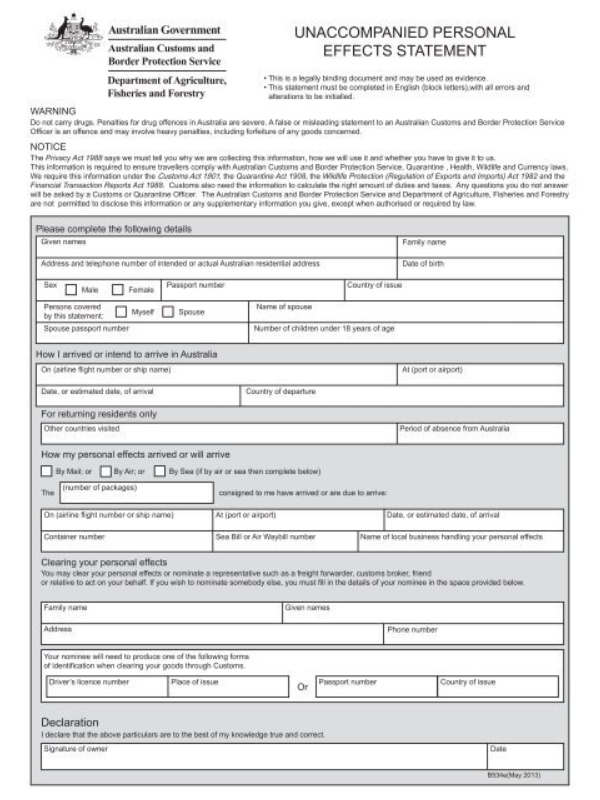

Australia customs form sample

Below is a sample of the Australia B534 customs form. It's available in several languages, including French, Arabic, Spanish, Greek and Chinese, but you must complete it in English.

Who is eligible for tax relief using a B534 form?

You may be exempt from customs duty and GST if you meet the following criteria:

- You are a passenger of a ship or aircraft.

- You arrive from a country outside Australia and meet permanent residency requirements.

- You have owned the goods you are sending for more than 12 months before your departure and intend to use them after you arrive in Australia.

Permanent residents include Australian citizens, permanent visa holders and special category visa holders, such as students and temporary workers.

Australia's Department of Agriculture, Fisheries and Forestry enforces strict regulations regarding goods containing soil, dirt, and other organic contaminants, like bikes, shoes and garden furniture. Please thoroughly clean and dry these items before packing.

How to fill out customs form for Australia

To clear your UPEs into Australia, you must first fill in a B534 customs form. Typically, the removals company that sends your belongings will require you to fill out this form before shipping.

First, provide photocopies of your passport photo page (plus all stamped pages and your Australian visa page) for each item owner over eighteen.

Next, complete all four pages of your customs statement using a black pen to sign and date each page at the bottom.

- Page 1: personal and travel details, including your Australian address and intended arrival dates. Specify how your effects will arrive (by air or sea) and name the shipping company you're using. Returning residents must list all countries visited since last residing in Australia.

- Page 2: answer questions about your purpose in Australia, packing, content awareness and declarations.

- Page 3: declare all prescription or over-the-counter medicines, cash, tobacco, alcohol, etc.

- Page 4: declare any wildlife and its derivatives, food, biological specimens, and plant matter.

Please complete your B534 form promptly and accurately to avoid processing or quarantine delays.

Next, you have two options to lodge your UPE statement:

Option 1

Visit an ABF counter in person and undergo an Evidence of Identity (EOI) check.

You must also bring:

- Your completed and signed UPE statement Goods permit (if required)

- Delivery order from the company transporting your belongings

- A packing list of all items you're shipping

- Evidence of your goods' value if owned for less than a year

Option 2

Submit your statement electronically (including the documents required in option 1) via an international removals company.

Your personal effects can arrive in Australia before or after you. However, there must be a clear connection between your travel to the country and your goods importation. For example, the UPE concession cannot be used to import your personal effects several months after you arrive in Australia.

If you arrange transportation of your personal effects before you arrive in Australia, you must provide proof of your intention to travel to the country within a reasonable timeframe, such as an airline ticket, a work contract, or a university acceptance letter.

What goods can enter Australia tax-free with a B534 form?

The following are examples of typical unaccompanied household goods that you can ship to Australia tax-free with a B534 form (if eligible):

- Clothing

- Footwear

- Electronics

- Kitchen appliances

- Furniture

- Books

- Artwork

- Decorative items

- Bedding and linens

- Bathroom products

- Toys and games

- Musical instruments

- Sports equipment

- Tools and hardware

- Cookware and utensils

- Small kitchen devices (e.g. coffee makers and toasters)

- Memorabilia and collectibles

The following goods are not considered UPEs and are unavailable for concessions using a B534 form:

- Motorised vehicles

- Motor vehicle parts

- Goods intended for sale

- Bequeathed goods

- Items purchased online after you arrive in Australia

- Items belonging to persons ineligible for UPE concessions

- Tobacco and tobacco products

- Alcoholic beverages

- Fresh fruits, vegetables, meat and specific plant and animal products

Please check our Prohibited Goods page for a detailed list of items banned from being imported into Australia.